The Eurozone in 2024: Challenges and Opportunities

Despite a resilient early start in 2023, the eurozone economy was weak through much of the year, and we anticipate that this fragility will persist in 2024. After hitting a high of around 54 in April 2023, the eurozone Composite Purchasing Managers’ Index fell below 50 in June and has remained there since, indicating an economy in mild contraction. Our forecast is for a period of stagnation or a mild contraction in the eurozone this year (for more on our global economic outlook, see our latest Cyclical Outlook, “Navigating the Descent”).

The reasons for this ongoing weakness are clear. Europe is still recovering from a lingering energy shock and has not experienced the same degree of fiscal stimulus as the more resilient U.S. economy in recent years. The region’s shorter debt maturities also mean that interest rate hikes have been felt more quickly.

Europe’s challenges have been exacerbated by an underperforming Germany, which has been a drag on regional growth. German industrial production experienced its sixth consecutive monthly decline in November, contracting by 0.7% month-over-month against consensus expectations of a 0.3% increase. This aligns with recent declines in German industrial orders, underscoring persistent fragility within the German manufacturing sector.

While softness in Germany partly mirrors weakness in the global industrial cycle, structural headwinds – such as a loss of competitiveness vis-à-vis China and higher gas prices since the onset of the Ukraine war – are also likely playing a role. There is also little hope that fiscal policy will come to the rescue, given recent constitutional court decisions. Granted, there are some signs we are past the peak in terms of weakness, but there is little evidence to suggest German industry is turning a corner in a decisive way, and the overarching picture is of an economy struggling to gain momentum. Given that Germany accounts for over a quarter of eurozone GDP, its impact on the wider region is significant.

As for potential shocks in 2024, we do not expect the current shipping turmoil in the Red Sea to have a major impact on inflation in Europe, as it stands. Its scale is a fraction of the pandemic-related disruption, and shipping itself is only a small component of the cost structure of a company. Global goods demand is not as buoyant as it was during the pandemic, and the supply of new container ships looks set to be ample this year. Importantly, there are other supply routes available to companies, including alternative sea routes and air freight. That said, COVID-19 taught us to be wary of ripple effects on the supply chain.

Inflation and rates outlook

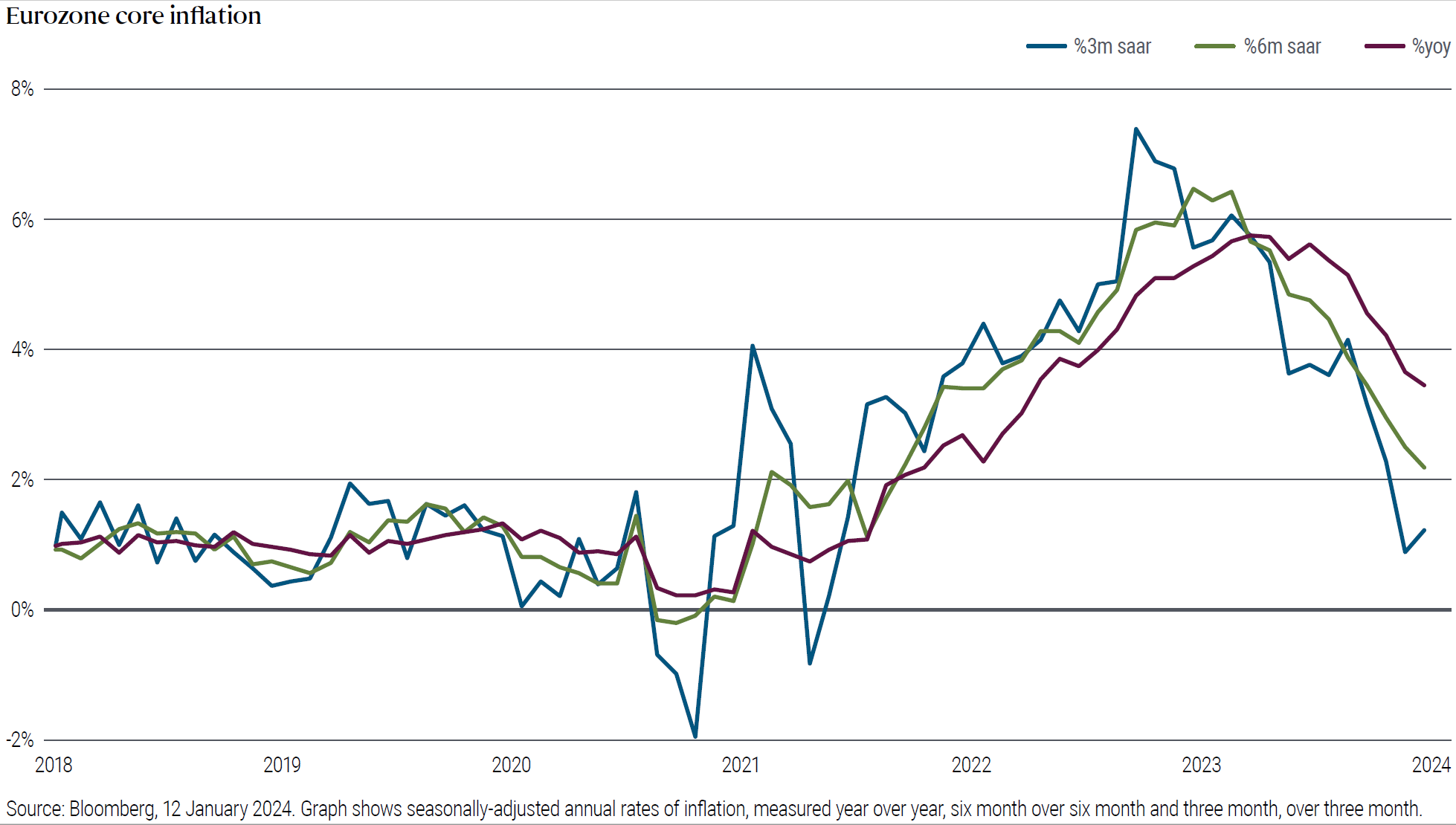

Inflation has peaked in Europe and is now falling rapidly, with headline inflation already below 3% in the eurozone and core inflation slowing to around 3.5% year-over-year. At higher-frequency measures, inflation has fallen even lower – Figure 1 shows that on a three-month annualised basis, core inflation is below the European Central Bank’s 2% target.

Figure 1: Eurozone core inflation

We believe the European Central Bank has finished its round of tightening and will look to cut rates this year. We see the ECB proceeding with caution initially, given that the central bank will want to feel certain it has won the fight against inflation (and it may want to see signs of wage disinflation first), but from our perspective, rates are on the way down.

The ECB, like other developed market central banks, is wary of monetary policy mistakes that would allow inflation to reaccelerate – a problem now synonymous with former Federal Reserve Chair Arthur Burns, whose dovish policy stance in the 1970s contributed to an unwelcome phase of reflation in the U.S. economy. Given this, the ECB may end up cutting the policy rate by less than what the market currently is pricing for this year. Beyond that, however, we see potential for deeper cuts versus what is priced, given our view that equilibrium interest rates in Europe and globally remain low.

What does this macro outlook mean for European bond markets? We are cautious on the front end of the curve but we do see opportunities in the intermediate part, with our forecast for deeper rate cuts over time alongside our view that destination policy rates remain low. Being in this part of the curve also avoids the long-end which may be susceptible to elevated issuance needs and the ECB reducing its balance sheet. We consider European duration to be an effective portfolio diversifier: Although yields are generally lower compared with the U.S., the relatively subdued macroeconomic outlook for the region should allow European fixed income markets to perform.

Importantly, duration interest rate risk has hedging properties, so if we experience a deeper downturn than anticipated, fixed income duration should perform. Also, while cash has been king for many investors, cash yields are fleeting and are unlikely to be as high tomorrow as they are today. Locking in higher yields by having some duration exposure in portfolios makes sense, in our view.

Featured Participants

Disclosures

PIMCO Europe Ltd (Company No. 2604517, 11 Baker Street, London W1U 3AH, United Kingdom) is authorised and regulated by the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN) in the UK. The services provided by PIMCO Europe Ltd are not available to retail investors, who should not rely on this communication but contact their financial adviser. PIMCO Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany), PIMCO Europe GmbH Italian Branch (Company No. 10005170963, Via Turati nn. 25/27, 20121 Milan, Italy), PIMCO Europe GmbH Irish Branch (Company No. 909462, 57B Harcourt Street Dublin D02 F721, Ireland), PIMCO Europe GmbH UK Branch (Company No. FC037712, 11 Baker Street, London W1U 3AH, UK), PIMCO Europe GmbH Spanish Branch (N.I.F. W2765338E, Paseo de la Castellana 43, Oficina 05-111, 28046 Madrid, Spain) and PIMCO Europe GmbH French Branch (Company No. 918745621 R.C.S. Paris, 50–52 Boulevard Haussmann, 75009 Paris, France) are authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie- Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 15 of the German Securities Institutions Act (WpIG). The Italian Branch, Irish Branch, UK Branch, Spanish Branch and French Branch are additionally supervised by: (1) Italian Branch: the Commissione Nazionale per le Società e la Borsa (CONSOB) (Giovanni Battista Martini, 3 - 00198 Rome) in accordance with Article 27 of the Italian Consolidated Financial Act; (2) Irish Branch: the Central Bank of Ireland (New Wapping Street, North Wall Quay, Dublin 1 D01 F7X3) in accordance with Regulation 43 of the European Union (Markets in Financial Instruments) Regulations 2017, as amended; (3) UK Branch: the Financial Conduct Authority (FCA) (12 Endeavour Square, London E20 1JN); (4) Spanish Branch: the Comisión Nacional del Mercado de Valores (CNMV) (Edison, 4, 28006 Madrid) in accordance with obligations stipulated in articles 168 and 203 to 224, as well as obligations contained in Tile V, Section I of the Law on the Securities Market (LSM) and in articles 111, 114 and 117 of Royal Decree 217/2008, respectively and (5) French Branch: ACPR/Banque de France (4 Place de Budapest, CS 92459, 75436 Paris Cedex 09) in accordance with Art. 35 of Directive 2014/65/EU on markets in financial instruments and under the surveillance of ACPR and AMF. The services provided by PIMCO Europe GmbH are available only to professional clients as defined in Section 67 para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2, Brandschenkestrasse 41 Zurich 8002, Switzerland). The services provided by PIMCO (Schweiz) GmbH are not available to retail investors, who should not rely on this communication but contact their financial adviser.

CMR2024-0118-3329152